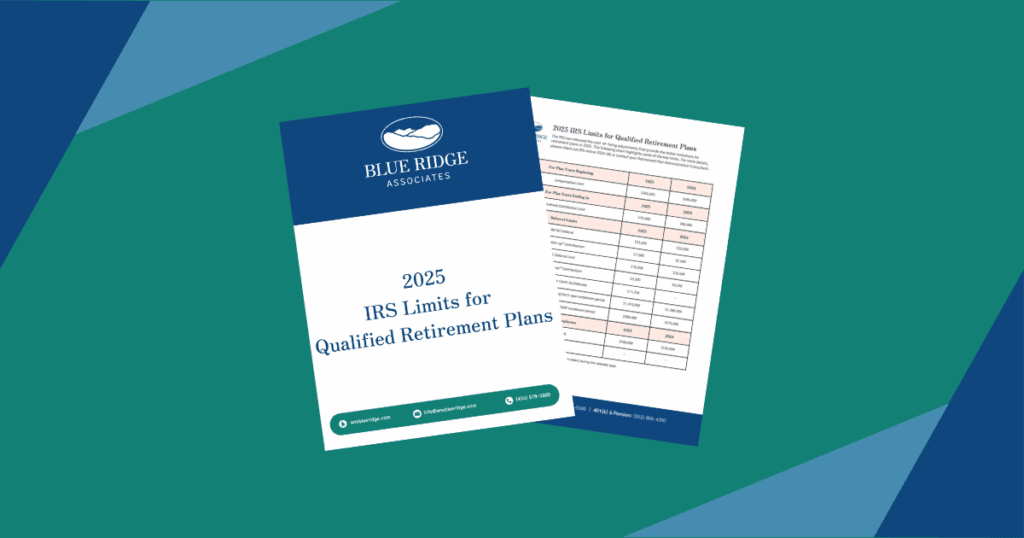

2025 IRS Limits for Qualified Retirement Plans

The IRS has released the 2025 cost-of-living adjustments for retirement plans. Our easy-to-read PDF summarizes the most important updates to contribution and compensation limits — a must-have reference for plan sponsors, HR professionals, and financial advisors.

Key 2025 Updates Include:

- 401(k) deferral limit increased to $23,500

- Defined Contribution Limit rises to $70,000

- Compensation Limit now $350,000

- New Age 60–63 Super Catch-Up Deferral: $11,250

- Updated thresholds for SIMPLE plans and ESOPs

Ensure your retirement plan strategy is up to date. Download our 2025 IRS Limits quick-reference PDF:

Download the 2025 IRS Limits Guide Here

For more details, refer to IRS Notice 2024-80 or connect with your Blue Ridge Associates Retirement Plan Administration Consultant.